There’s never been a better time to take control of your finances thanks to the growth of apps that help you save money, create a budget planner, and act as money managers.

However, with so many personal finance apps available on the market, and with costs ranging from free to pay-per-month, how do you know which apps will help you save money and gain control over your finances?

Key Personal Finance App Features

One of the most important things to watch out for is whether your money is protected by the FDIC if you want to use an app that handles your money for you. This ensures that your funds are secure in case the company goes bankrupt.

Also, any app that handles your financial information needs to use industry-standard encryption to prevent identity theft and fraud. For additional security, you want to choose apps that offer two-factor authentication and ensure that your phone is protected by a secure password or if you have it, fingerprint recognition.

Our Top 10 Personal Finance Apps

1. Digit.co

Digit’s app is a savings app that analyzes your daily spending and automatically saves money that you won’t miss from your bank account. You can also set customized goals and tell Digit where to send your savings money, and every three months they give you a 0.5% savings bonus.

Price: $5/month

Website: digit.co

2. Clarity Money

Price: Free

Website: Marcus.com/clarity-money

3. Mint

Mint automatically categorizes your transactions in real-time, allowing you to track your budget throughout the day. It’ll also send you an alert if you go over your budget.

Price: Free

Website: Mint.com

4. Personal Capital

Personal Capital collects information from all of your bank accounts in one place so you can monitor your financial health. Plus, it helps you plan for retirement with its Retirement Planner.

Price: Free

Website: PersonalCapital.com

5. Chime

Chime offers both a spending and a savings account, and by using their debit card, your transactions are automatically rounded to the nearest dollar and transferred to your savings account.

Price: Free

Website: Chime.com

6. Acorns

Acorns rounds your purchases up to the nearest dollar and transfers that amount into your Acorns account, which you can then invest in a customized portfolio.

Price: $1 / month

Website: Acorns.com

7. YNAB

You Need A Budget helps users create. a plan for every dollar they earn with its free resources and workshops. You can also connect your bank accounts and set savings goals.

Price: $11.99 / month or $84 / year

Website: YouNeedaBudget.com

8. EveryDollar

With EveryDollar, you can create a monthly budget quickly and simply. You can also connect your bank account to automatically track transactions with their premium service.

Price: Free, or $129.99 / year for Premium/span>

Website:Everydollar.com

9. PocketGuard

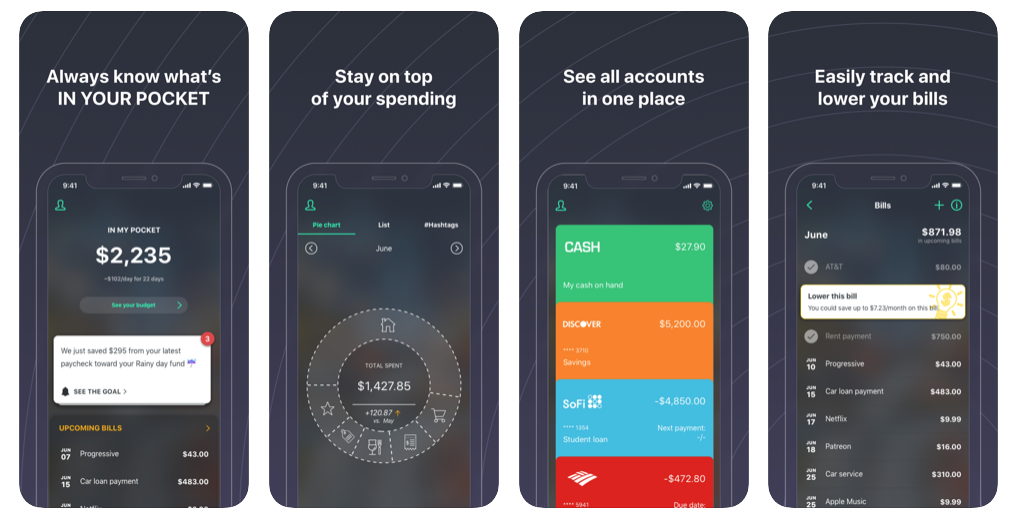

PocketGuard is a budget tracker that tells you exactly how much you have to spend each day, week or month after your expenses are accounted for.

Price: Free

Website: PocketGuard.com

10. Goodbudget

Goodbudget lets you budget your monthly income into separate “envelopes”, and also allows multiple family members to share your budget.

Price: Free, or $50 / year for Premium

Website: GoodBudget.com

Ready to lower your monthly bills?

Chat with a Tallie agent now to see what we can do for you. No fees and no obligation to sign up.